검색결과 리스트

관심종목에 해당되는 글 159건

- 2018.08.13 서정진, 셀트리온 원가경쟁력 높이기 위해 베트남에 3공장 세우나

- 2018.08.10 서정진, 셀트리온 대장암치료 바이오시밀러 가격으로 승부 건다

- 2018.08.10 Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018

- 2018.08.09 셀트리온, 2분기 매출 2634억..트룩시마 비중 57%

- 2018.08.08 Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자"

- 2018.08.06 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까

- 2018.07.17 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉

- 2018.07.06 posco 견조한 실적 지속

- 2018.06.26 [중국인물] 7조원짜리 과외기업 만든 사교육의 대부 장방신

글

셀트리온 회장이 셀트리온 3공장 건설 계획을 놓고 고심을 거듭하고 있다.

서 회장은 지난해 9월 ‘북핵 위기’를 이유로 송도에 짓기로 했던 3공장을 해외에 짓겠다고 발표했는데 공장 부지 선정이 자꾸 미뤄지고 있다.

서 회장이 부지 선정을 놓고 기준을 바꿀 가능성도 내비쳐 그 배경이 주목된다.

◆ 서정진, 셀트리온 해외3공장 베트남에 짓나

12일 셀트리온에 따르면 36만 리터 규모의 셀트리온 3공장을 건설할 공장 부지는 올해 하반기에 발표된다.

서 회장은 올해 6월 그랜드 인터컨티넨탈 서울 파르나스에서 열린 ‘2018 글로벌 바이오 콘퍼런스’에서 “당초 상반기 안에 제3공장 최종 후보지를 발표할 예정이었으나 각 국가의 조건과 제안 등을 검토하는 과정에서 예상보다 늦어졌다”며 “동남아를 비롯해 다양한 국가를 대상으로 다각적으로 검토 중이며 올해 안에 확정하겠다”고 말했다.

서 회장이 동남아 지역을 든 것을 놓고 베트남이 셀트리온 3공장 유력 후보지가 아니냐는 말도 나오고 있다.

올해 5월 베트남 언론을 통해 장신재 셀트리온 사장이 베트남을 방문했다는 사실이 알려졌다. 장 사장은 셀트리온 창업 멤버로서 현재 제3공장 추진 태스크포스(TF)부문장을 맡고 있다.

베트남 언론에 따르면 셀트리온은 베트남 정부의 강력한 지원 아래 8억 달러를 들여 36만 리터의 공장을 짓는 것을 적극 검토하고 있다. 현지 베트남 대학과 연구 인력 및 사업 협력도 강화한다.

셀트리온이 베트남에 건설을 검토하고 있는 공장이 바이오의약품을 생산하는 3공장인지, 합성의약품 공장인지 아니면 원료의약품 공장인지는 알려지지 않았다.

셀트리온의 3공장 건설 계획은 수차례 변경되면서 규모와 위치, 공장 설립 목적도 그때마다 수정되고 있다.

셀트리온은 2006년 5만 리터 규모의 1공장을 지었고 2009년에는 9만 리터 규모의 2공장을 지었다.

셀트리온 3공장은 당초 송도 부지의 잔디밭에 짓기로 되어 있었다. 기존 2공장에 땅콩집 형태로 붙여 확장하는 방식으로 3공장 설계도도 2공장 건설 이전에 이미 완성돼 있었다.

셀트리온은 2016년 5월 이사회를 열고 3251억 원을 투자해 1공장을 5만 리터에서 10만 리터로 증설하고 3공장도 12만 리터 규모로 건설하기로 결정했다. 셀트리온은 2019년 3공장을 완공해 2021년 상업생산을 시작하는 것을 목표로 세웠다.

그러나 서 회장은 지난해 9월29일 열린 셀트리온 코스피 이전 안건 처리를 위한 임시 주주총회에서 “해외 바이어들이 북핵 위기로 공급에 차질이 빚어질까 우려한다”며 12만 리터 규모의 3공장을 해외에 건설하겠다고 밝혔다.

서 회장은 이어 올해 초 미국에서 열린 JP모건 헬스케어 컨퍼런스에서는 3공장 규모를 기존 계획보다 3배 늘린 36만 리터 규모로 짓겠다고 밝혔다. 2월 이탈리아 베니스에서 열린 ‘2018 셀트리온헬스케어 인터내셔널 서밋’에서는 올해 상반기 안에 3공장 건설 부지를 결정하겠다고 발표했다.

그러나 서 회장은 올해 6월 3공장 부지 선정이 하반기로 연기되었다고 밝혔다.

◆ 서정진, 셀트리온 3공장 놓고 무엇을 고민하나

셀트리온 3공장은 당초 미국이 유력하다고 여겨졌다.

셀트리온이 미국시장 공략에 노력을 꾀하고 있어 현지 생산이 가능하고 선진국인 미국이 품질관리에도 쉽기 때문이다.

| ▲ 셀트리온 2공장. |

서 회장은 올해 3월 주주총회에서 “무균 시설이기 때문에 후진국에서는 불안해서 못 한다”며 “현재도 위탁생산(CMO)를 미국·유럽에서 하고 있다”고 말했다.

그러나 서 회장은 올해 6월 2018 글로벌 바이오 컨퍼런스에서 3공장 부지 선정 기준이 다소 바뀌었음을 내보였다.

서 회장은 “무엇보다 제품의 원가 경쟁력을 확보할 수 있는 곳이어야 한다”며 “동남아 등 제조 원가를 낮출 수 있는 지역에 제 3공장을 설립할 계획”이라고 말했다.

서 회장은 “여러 국가에서 제안이 오고 있어 검토 과정이 길어지고 있다”고 덧붙였다.

서 회장의 발언을 종합해보면 3공장 부지 선정의 기준이 ‘품질 관리’에서 ‘원가 경쟁력’으로 무게 중심이 옮겨지고 있는 것으로 보인다.

그동안 서 회장은 셀트리온의 원가 경쟁력을 자신해왔다.

서 회장은 올해 초 열린 JP모건 헬스케어 컨퍼런스에서 바이오시밀러의 경쟁력은 제조원가가 결정한다”며 “셀트리온은 암젠과 제넨텍 등 세계적 바이오기업들보다 월등한 원가 경쟁력을 보유하고 있다”고 말했다.

그러나 최근 바이오시밀러시장 경쟁은 한층 치열해지고 있다.

셀트리온은 올해 2분기에 연결기준으로 매출 2634억 원, 영업이익 1082억 원을 냈다. 지난해 같은 기간보다 매출은 7% 늘어났지만 영업이익은 21.7% 줄었다. 주력 바이오시밀러 상품인 램시마의 판매단가가 시장경쟁심화로 낮아진 점이 영업이익 감소의 원인 가운데 하나였다.

셀트리온이 최근 바이오시밀러 생산 외에 바이오의약품 위탁개발생산(CDMO)사업으로 진출하면서 공장의 원가 경쟁력이 더욱 중요해진 것도 영향을 끼친 것으로 보인다.

바이오의약품 위탁개발생산은 최근 급속히 뜨고 있는 사업분야이지만 바이오시밀러 판매보다 이익이 훨씬 적게 남고 수주 경쟁도 치열해 원가 경쟁력이 무엇보다도 중요하다.

서 회장은 “해외 3공장에서 바이오의약품 위탁개발생산(CDMO) 사업을 본격화할 것”이라며 “파트너사들도 새 공장을 선호한다”고 말했다. [비즈니스포스트 이승용 기자]

'관심종목' 카테고리의 다른 글

| 바이오시밀러서 신약 개발로 영역 넓히는 삼성바이오 (0) | 2018.08.13 |

|---|---|

| 앨나일람 RNA 간섭 치료제 온파트로 FDA 승인 유전자 침묵 기술 활용...최초의 치료제 (0) | 2018.08.13 |

| 서정진, 셀트리온 대장암치료 바이오시밀러 가격으로 승부 건다 (0) | 2018.08.10 |

| Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018 (0) | 2018.08.10 |

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

글

셀트리온이 대장암 치료제 바이오의약품 아바스틴의 바이오시밀러 개발을 위한 임상3상에 들어간다.

서정진 셀트리온그룹 회장은 셀트리온이 경쟁사들보다 아바스틴 바이오시밀러 개발에 뒤처지고 있다는 약점을 극복하기 위해 가격을 대폭 낮추는 전략을 펼 것으로 보인다.

| ▲ 서정진 셀트리온 회장. |

10일 셀트리온에 따르면 아바스틴 바이오시밀러 출시 경쟁과 관련해 셀트리온이 ‘가격 경쟁력’에 높이는 방안을 찾는 데 집중하고 있다.

셀트리온은 최근 포르투갈 의약품 허가기관에 아바스틴 바이오시밀러 ‘CT-P16’ 출시를 위한 글로벌 임상3상을 신청했다.

이에 앞서 셀트리온은 2017년 6월부터 1년 동안 국내에서 CT-P16의 안전성과 약동학(농도에 따른 약효 발현 속도) 평가를 위한 임상1상을 진행했고 최근 성공적으로 마쳤다. 바이오시밀러는 임상2상이 면제된다.

셀트리온은 포르투갈을 시작으로 유럽, 남미 지역 등 각 국가에 순차적으로 임상시험을 신청해 20여 개국, 약 150임상기관에서 CT-P16의 임상 3상을 진행한다.

아바스틴은 로슈가 2004년 대장암 치료제로 출시한 바이오의약품이다. 그 뒤 전이성 직결장암, 전이성 유방암, 비소세포폐암, 교모세포종, 난소암, 황반변성 치료로 사용 범위가 확대됐다. 지난해 기준 글로벌시장에서 매출 규모는 7조5천억 원 정도다.

아바스틴은 미국에서 2019년 7월, 유럽에서 2020년 1월 특허가 만료된다. 난소암 치료 등에 추가 특허가 붙어 있는 것으로 알려졌다.

셀트리온은 아바스틴 바이오시밀러 개발 경쟁에서 다소 뒤처져 있다는 평가를 받고 있다.

암젠은 엠바시라는 이름으로 아바스틴 바이오시밀러를 개발해 2017년 9월 미국 식품의약국(FDA)으로부터 판매허가를 받았다. 2018년 1월에는 유럽 의약품청(EMA)에서도 판매승인을 받았다.

화이자도 임상3상을 마쳤고 베링거잉겔하임과 삼성바이오에피스도 임상3상을 진행 중이다.

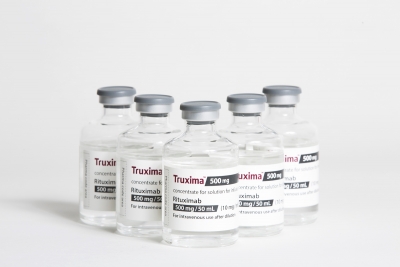

셀트리온은 그동안 바이오시밀러시장을 선점하는 데 주력했고 성공을 거뒀다. 바이오의약품 레미케이드의 바이오시밀러인 ‘램시마’와 리툭산의 바이오시밀러 ‘트룩시마’ 등으로 유럽시장을 선점했다. 최근에는 허셉틴의 바이오시밀러인 ‘허쥬마’의 시장 선점을 위해 힘쓰고 있다.

바이오시밀러 개발에는 1종당 평균 3천억 원이 들어간다. 바이오시밀러를 개발해 출시했지만 시장 경쟁에서 밀린다면 셀트리온이 입는 타격도 만만치 않다.

| ▲ 로슈의 바이오의약품 '아바스틴'. |

서 회장은 아바스틴 개발 경쟁에서 뒤처진 약점을 가격 경쟁력으로 극복하는 데 힘쓸 것으로 예상된다. 생산원가를 최대한 낮춰 개발해 경쟁사보다 가격을 낮게 책정하는 데 초점을 맞출 것이란 얘기다.

그는 아바스틴 바이오시밀러 개발과 관련해서 일관되게 ‘아바스틴은 시장 선점보다 가격 경쟁력이 중요하다’고 강조해왔다.

올해 초 열린 JP모건 헬스케어 컨퍼런스에서도 서 회장은 “아바스틴은 가격 경쟁력을 바탕으로 시장 진입을 시도하겠다”고 말했다.

서 회장이 기존과 다르게 아바스틴의 가격 경쟁력에 집중하는 것은 아바스틴이 다른 바이오의약품들보다 비싼 바이오의약품에 속하기 때문이다.

아바스틴은 암환자가 1년 동안 복용하면 약값이 5천만 원을 넘는 것으로 알려졌다. 오리지날보다 조금 더 싼 수준으로는 아바스틴 바이오시밀러 경쟁에서 이기기가 쉽지 않다.

서 회장은 아바스틴 바이오시밀러 품질과 관련해서도 “CT-P16은 외부 전문가들로부터 우리가 만든 바이오시밀러 중에서도 동등성이 가장 완벽한 것으로 평가받았다”고 자신하고 있다.

'관심종목' 카테고리의 다른 글

| 앨나일람 RNA 간섭 치료제 온파트로 FDA 승인 유전자 침묵 기술 활용...최초의 치료제 (0) | 2018.08.13 |

|---|---|

| 서정진, 셀트리온 원가경쟁력 높이기 위해 베트남에 3공장 세우나 (0) | 2018.08.13 |

| Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018 (0) | 2018.08.10 |

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

글

Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018

설정

트랙백

댓글

http://globenewswire.com/news-release/2018/08/07/1548566/0/en/Star-Bulk-Carriers-Corp-Reports-Financial-Results-for-the-Second-Quarter-and-First-Half-of-2018.html

ATHENS, Greece, Aug. 07, 2018 (GLOBE NEWSWIRE) -- Star Bulk Carriers Corp. (the "Company" or "Star Bulk") (Nasdaq: SBLK, Oslo: SBLK-R), a global shipping company focusing on the transportation of dry bulk cargoes, today announced its unaudited financial and operating results for the second quarter and the first half of 2018.

Financial Highlights

| (Expressed in thousands of U.S. dollars, except for daily rates and per share data) | Second quarter 2018 | Second quarter 2017 | Six months ended June 30, 2018 | Six months ended June 30, 2017 | ||||||||

| Voyage Revenues | $ | 132,604 | $ | 78,605 | $ | 253,661 | $ | 143,471 | ||||

| Net income/(loss) | $ | 10,728 | $ | (10,279 | ) | $ | 20,628 | $ | (26,229 | ) | ||

| EBITDA (1) | $ | 49,388 | $ | 22,665 | $ | 93,837 | $ | 37,039 | ||||

| Adjusted EBITDA (1) | $ | 52,028 | $ | 25,731 | $ | 98,450 | $ | 43,806 | ||||

| Adjusted Net income / (loss) (2) | $ | 13,377 | $ | (7,643 | ) | $ | 25,236 | $ | (20,515 | ) | ||

| Earnings / (loss) per share basic | $ | 0.17 | $ | (0.16 | ) | $ | 0.32 | $ | (0.42 | ) | ||

| Earnings / (loss) per share diluted | $ | 0.17 | $ | (0.16 | ) | $ | 0.32 | $ | (0.42 | ) | ||

| Adjusted earnings / (loss) per share basic and diluted (2) | $ | 0.21 | $ | (0.12 | ) | $ | 0.39 | $ | (0.33 | ) | ||

| Average Number of Vessels | 73.5 | 69.5 | 72.8 | 68.4 | ||||||||

| TCE Revenues (3) | $ | 89,991 | $ | 61,074 | $ | 171,588 | $ | 110,086 | ||||

| Daily Time Charter Equivalent Rate ("TCE") (3) | $ | 13,567 | $ | 9,747 | $ | 13,082 | $ | 8,968 | ||||

| Fleet utilization | 99.3 | % | 99.1 | % | 99.6 | % | 99.1 | % | ||||

| Average daily OPEX per vessel (excluding pre-delivery expenses) (4) | $ | 3,996 | $ | 3,880 | $ | 3,993 | $ | 3,914 | ||||

| Average daily Net Cash G&A expenses per vessel (excluding one-time expenses) (5) | $ | 1,072 | $ | 1,101 | $ | 1,086 | $ | 1,109 | ||||

- EBITDA and Adjusted EBITDA are non-GAAP measures. Please see the table at the back of this release for a reconciliation of EBITDA and Adjusted EBITDA to Net Cash Provided by / (Used in) Operating Activities, which is the most directly comparable financial measure calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). To derive Adjusted EBITDA from EBITDA, we exclude non-cash gains / (losses).

- Adjusted Net income / (loss) and Adjusted earnings / (loss) per share basic and diluted are non-GAAP measures. Please see the table at the back of this release for a reconciliation to Net income / (loss), which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP.

- Daily Time Charter Equivalent Rate (“TCE”) and TCE Revenues are non-GAAP measures. Please see the table at the back of this release for a reconciliation to Voyage Revenues, which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP.

- Average daily OPEX per vessel is calculated by dividing vessel operating expenses by Ownership days.

- Average daily Net Cash G&A expenses per vessel is calculated by (1) deducting the Management fee Income from, and (2) adding the Management fee expense to, the General and Administrative expenses (net of stock-based compensation expense) and (3) then dividing the result by the sum of Ownership days and Charter-in days.

Petros Pappas, Chief Executive Officer of Star Bulk, commented:

“We are pleased to report the third consecutive profitable quarter, where we achieved $90.0 million in TCE Revenues, $52.0 million in Adjusted EBITDA and $13.4 million in Adjusted Net Income for Q2 2018. Our average TCE for the quarter continued to increase quarter on quarter to $13,567/ day per vessel, while daily Opex and Net Cash G&A expenses per vessel were held at $3,996/day and $1,072/day respectively. As of today, we have fixed 60% of Q3 2018 days at average TCE rates of $13,882 / day.

We are happy to have closed all three of our recently announced acquisitions adding 34 high quality vessels with an average age of 5.2 years and average size of 119,105 dwt. Our Board of Directors has been enhanced with the addition of Raffaele Zagari and Arne Blystad, while Herman Billung has joined our management team.

We are optimistic about market fundamentals of the industry given the strengthening rate and asset value environment. Dry bulk supply is presently expanding at the lowest pace of the last decade while demand is supported by healthy ton-mile growth due to continued Chinese demand for higher quality raw materials. Our Company is positioning itself to take advantage of a firming market and deliver value to its shareholders.”

Recent Developments

Acquisitions

- On June 28, 2018, we closed the previously announced acquisition of three newbuilding Newcastlemax dry bulk vessels (“OCC Vessel Purchase Transaction”), from Oceanbulk Container Carriers LLC (“OCC”), an entity affiliated with Oaktree Capital Management, L.P. (“Oaktree”) and with family members of our CEO, Mr. Petros Pappas (“Pappas Shareholders”). The final consideration for the OCC Vessel Purchase Transaction was 3.3 million of our common shares. The three vessels are being constructed at Shanghai Waigaoqiao Shipbuilding Co. (“SWS”), with expected delivery dates in the first half of 2019. CSSC (Hong Kong) Shipping Company Limited has agreed to provide $104.4 million to finance the remaining $103.8 million capital expenditure of the three vessels via a ten-year capital lease.

- On July 6, 2018 we closed the previously announced acquisition of 15 operating dry bulk vessels (the “Songa Vessels”) from Songa Bulk ASA (“Songa”) for an aggregate of 13.7 million of our common shares (the “Songa Consideration Shares”) and $145.0 million in cash (the “Songa Vessel Purchase Transaction”). The cash portion of the consideration was financed through proceeds of a new five-year capital lease of $180.0 million with China Merchants Bank Leasing, thus offering approximately $35.0 million of additional liquidity. Following the closing of the Songa Vessel Purchase Transaction, Mr. Arne Blystad was appointed to our Board of Directors as Class C Director and Mr. Herman Billung joined our management team as Senior Vice President. As part of this transaction, we commenced trading on the Oslo Stock Exchange under the ticker “SBLK R” on July 16, 2018. The Songa Consideration Shares will be restricted from trading in the U.S. for a period of six months following the distribution of the Songa Consideration Shares to the shareholders of Songa, unless they are sold pursuant to a transaction exempt from, or not subject to, registration under the Securities Act of 1933, as amended (the “Act”). The offer and sale of the Songa Consideration Shares will not be registered under the Act, and they may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements under the Act.

- On August 3, 2018, we closed the previously announced acquisition of 16 operating dry bulk vessels (the “Augustea Vessels”) from entities affiliated with Augustea Atlantica SpA and York Capital Management in an all-share transaction (the “Augustea Vessel Purchase Transaction”). An entity affiliated with family members of our CEO, Mr. Petros Pappas, is a passive minority investor in three of the Augustea Vessels. Following the completion of this transaction, Mr. Raffaele Zagari was appointed to our Board of Directors. The final consideration for the Augustea Vessel Purchase Transaction was 10.3 million common shares of the Company. As part of this transaction, we assumed debt of approximately $309.0 million.

Following the consummation of all three transactions above, we have 91,521,052 common shares outstanding as of the date of this press release.

Financing Activities

- In July, 2018, we entered into a committed term-sheet with HSBC Bank plc for a loan of $80.0 million (or the “HSBC $80,000 Facility”), to refinance the full amounts outstanding under the HSBC $86,600 Facility and the HSH $64,500 Facility (each as defined in the 2017 20-F). The loan will be secured by a first priority mortgage on the vessels previously pledged under the two refinanced facilities. We expect to draw down the loan amount of $80.0 million in the third quarter of 2018. The loan will be repayable in 20 equal quarterly installments of $2.4 million and a balloon payment along with the last installment in an amount of $32.4 million. The completion of the transaction is subject to the execution of customary definitive documentation.

- On July 27, 2018, we paid an aggregate amount of $22.7 million in total to all parties under our Supplemental Agreements (as defined in the 2017 20-F) pursuant to the cash sweep mechanism in the Supplemental Agreements.

Capital Markets’ Activities

- On June 26, 2018, we announced a secondary public offering of 5,000,000 of our common shares held by a fund affiliated with Oaktree Capital Management, L.P. The offering closed on June 29, 2018 at a price of $13.10 per share. The Company did not sell any common shares and did not receive any proceeds as a result of this offering.

Employment update

As of today, we have fixed employment for approximately 60% of the days in Q3 2018 at average TCE rates of $13,882 per day.

More specifically:

Capesize Vessels: approximately 46% of Q3 2018 days at $19,848 per day.

Panamax Vessels: approximately 64% of Q3 2018 days at $12,252 per day.

Supramax Vessels: approximately 70% of Q3 2018 days at $11,689 per day.

Existing On the Water Fleet (As of August 7, 2018)

| Vessel Name | Vessel Type | Capacity (dwt.) | Year Built | Date Delivered to Star Bulk | |||||

| 1 | Goliath | Newcastlemax | 209,537 | 2015 | July-15 | ||||

| 2 | Gargantua | Newcastlemax | 209,529 | 2015 | April-15 | ||||

| 3 | Star Poseidon | Newcastlemax | 209,475 | 2016 | February-16 | ||||

| 4 | Maharaj | Newcastlemax | 209,472 | 2015 | July-15 | ||||

| 5 | ABOY Sienna (1) | Newcastlemax | 208,000 | 2017 | August-18 | ||||

| 6 | ABOY Laetitia (1) | Newcastlemax | 208,000 | 2017 | August-18 | ||||

| 7 | ABOY Karlie (1) | Newcastlemax | 208,000 | 2016 | August-18 | ||||

| 8 | Star Leo (1) | Newcastlemax | 207,939 | 2018 | May-18 | ||||

| 9 | Star Ariadne (1) | Newcastlemax | 207,812 | 2017 | March-17 | ||||

| 10 | Star Virgo (1) | Newcastlemax | 207,810 | 2017 | March-17 | ||||

| 11 | Star Libra (1) | Newcastlemax | 207,765 | 2016 | June-16 | ||||

| 12 | Star Marisa (1) | Newcastlemax | 207,709 | 2016 | March-16 | ||||

| 13 | Star Eleni (1) | Newcastlemax | 207,555 | 2018 | January-18 | ||||

| 14 | Star Magnanimus (1) | Newcastlemax | 207,490 | 2018 | March-18 | ||||

| 15 | Leviathan | Capesize | 182,511 | 2014 | September-14 | ||||

| 16 | Peloreus | Capesize | 182,496 | 2014 | July-14 | ||||

| 17 | Songa Claudine (1) | Capesize | 181,258 | 2011 | July-18 | ||||

| 18 | Songa Opus (1) | Capesize | 180,706 | 2010 | July-18 | ||||

| 19 | Star Martha | Capesize | 180,274 | 2010 | October-14 | ||||

| 20 | Star Pauline | Capesize | 180,274 | 2008 | December-14 | ||||

| 21 | Pantagruel | Capesize | 180,181 | 2004 | July-14 | ||||

| 22 | Star Borealis | Capesize | 179,678 | 2011 | September-11 | ||||

| 23 | Star Polaris | Capesize | 179,600 | 2011 | November-11 | ||||

| 24 | Songa Mountain (1) | Capesize | 179,150 | 2009 | July-18 | ||||

| 25 | ABY Scarlett | Capesize | 178,000 | 2014 | August-18 | ||||

| 26 | Star Angie | Capesize | 177,931 | 2007 | October-14 | ||||

| 27 | Big Fish | Capesize | 177,662 | 2004 | July-14 | ||||

| 28 | Kymopolia | Capesize | 176,990 | 2006 | July-14 | ||||

| 29 | Star Triumph | Capesize | 176,343 | 2004 | December-17 | ||||

| 30 | ABYO Audrey | Capesize | 175,125 | 2011 | August-18 | ||||

| 31 | Big Bang | Capesize | 174,109 | 2007 | July-14 | ||||

| 32 | Star Aurora | Capesize | 171,199 | 2000 | September-10 | ||||

| 33 | Paola | Mini-Capesize | 115,259 | 2011 | August-18 | ||||

| 34 | ABML Eva | Mini-Capesize | 106,659 | 2011 | August-18 | ||||

| 35 | Amami | Post Panamax | 98,681 | 2011 | July-14 | ||||

| 36 | Madredeus | Post Panamax | 98,681 | 2011 | July-14 | ||||

| 37 | Star Sirius | Post Panamax | 98,681 | 2011 | March-14 | ||||

| 38 | Star Vega | Post Panamax | 98,681 | 2011 | February-14 | ||||

| 39 | Piera | Post-Panamax | 91,951 | 2010 | August-18 | ||||

| 40 | Maria Laura Prima | Post Panamax | 91,945 | 2010 | August-18 | ||||

| 41 | Aphrodite | Post Panamax | 91,827 | 2011 | August-18 | ||||

| 42 | Songa Hirose (1) | Kamsarmax | 83,494 | 2011 | July-18 | ||||

| 43 | ABY Jeannette | Kamsarmax | 83,000 | 2014 | August-18 | ||||

| 44 | Star Angelina | Kamsarmax | 82,981 | 2006 | December-14 | ||||

| 45 | Star Gwyneth | Kamsarmax | 82,790 | 2006 | December-14 | ||||

| 46 | Star Kamila | Kamsarmax | 82,769 | 2005 | September-14 | ||||

| 47 | Songa Genesis (1) | Kamsarmax | 82,705 | 2010 | July-18 | ||||

| 48 | Songa Maru (1) | Kamsarmax | 82,687 | 2008 | July-18 | ||||

| 49 | Songa Grain (1) | Kamsarmax | 82,672 | 2008 | July-18 | ||||

| 50 | Pendulum | Kamsarmax | 82,619 | 2006 | July-14 | ||||

| 51 | Star Maria | Kamsarmax | 82,598 | 2007 | November-14 | ||||

| 52 | Star Markella | Kamsarmax | 82,594 | 2007 | September-14 | ||||

| 53 | Star Danai | Kamsarmax | 82,574 | 2006 | October-14 | ||||

| 54 | Star Georgia | Kamsarmax | 82,298 | 2006 | October-14 | ||||

| 55 | Star Sophia | Kamsarmax | 82,269 | 2007 | October-14 | ||||

| 56 | Star Mariella | Kamsarmax | 82,266 | 2006 | September-14 | ||||

| 57 | Star Moira | Kamsarmax | 82,257 | 2006 | November-14 | ||||

| 58 | Star Nina | Kamsarmax | 82,224 | 2006 | January-15 | ||||

| 59 | Star Renee | Kamsarmax | 82,221 | 2006 | December-14 | ||||

| 60 | Star Nasia | Kamsarmax | 82,220 | 2006 | August-14 | ||||

| 61 | Star Laura | Kamsarmax | 82,209 | 2006 | December-14 | ||||

| 62 | Star Jennifer | Kamsarmax | 82,209 | 2006 | April-15 | ||||

| 63 | Star Helena | Kamsarmax | 82,187 | 2006 | December-14 | ||||

| 64 | Songa Moon (1) | Kamsarmax | 82,158 | 2012 | July-18 | ||||

| 65 | Songa Hadong (1) | Kamsarmax | 82,158 | 2012 | July-18 | ||||

| 66 | ABY Asia (1) | Kamsarmax | 82,000 | 2017 | August-18 | ||||

| 67 | Songa Devi (1) | Kamsarmax | 81,918 | 2014 | July-18 | ||||

| 68 | Star Charis | Kamsarmax | 81,711 | 2013 | March-17 | ||||

| 69 | Star Suzanna | Kamsarmax | 81,711 | 2013 | May-17 | ||||

| 70 | Mercurial Virgo | Kamsarmax | 81,545 | 2013 | July-14 | ||||

| 71 | Songa Delmar (1) | Kamsarmax | 81,501 | 2011 | July-18 | ||||

| 72 | Songa Sky (1) | Kamsarmax | 81,466 | 2010 | July-18 | ||||

| 73 | Lydia Cafiero | Kamsarmax | 81,187 | 2013 | August-18 | ||||

| 74 | Nicole | Kamsarmax | 81,120 | 2013 | August-18 | ||||

| 75 | ABY Virginia | Kamsarmax | 81,000 | 2015 | August-18 | ||||

| 76 | Songa Flama (1) | Kamsarmax | 80,448 | 2011 | July-18 | ||||

| 77 | Star Iris | Panamax | 76,466 | 2004 | September-14 | ||||

| 78 | Star Emily | Panamax | 76,417 | 2004 | September-14 | ||||

| 79 | Idee Fixe (1) | Ultramax | 63,458 | 2015 | March-15 | ||||

| 80 | Roberta (1) | Ultramax | 63,426 | 2015 | March-15 | ||||

| 81 | Laura (1) | Ultramax | 63,399 | 2015 | April-15 | ||||

| 82 | Kaley (1) | Ultramax | 63,283 | 2015 | June-15 | ||||

| 83 | Kennadi | Ultramax | 63,262 | 2016 | January-16 | ||||

| 84 | Mackenzie | Ultramax | 63,226 | 2016 | March-16 | ||||

| 85 | Songa Wave (1) | Ultramax | 61,491 | 2017 | July-18 | ||||

| 86 | Star Challenger | Ultramax | 61,462 | 2012 | December-13 | ||||

| 87 | Star Fighter | Ultramax | 61,455 | 2013 | December-13 | ||||

| 88 | Star Lutas | Ultramax | 61,347 | 2016 | January-16 | ||||

| 89 | Honey Badger | Ultramax | 61,320 | 2015 | February-15 | ||||

| 90 | Wolverine | Ultramax | 61,292 | 2015 | February-15 | ||||

| 91 | Star Antares | Ultramax | 61,258 | 2015 | October-15 | ||||

| 92 | Star Acquarius | Ultramax | 60,916 | 2015 | July-15 | ||||

| 93 | Star Pisces | Ultramax | 60,916 | 2015 | August-15 | ||||

| 94 | ABY Monica | Ultramax | 60,000 | 2015 | August-18 | ||||

| 95 | Songa Glory (1) | Supramax | 58,680 | 2012 | July-18 | ||||

| 96 | Diva | Supramax | 56,582 | 2011 | July-17 | ||||

| 97 | Strange Attractor | Supramax | 55,742 | 2006 | July-14 | ||||

| 98 | Star Omicron | Supramax | 53,489 | 2005 | April-08 | ||||

| 99 | Star Gamma | Supramax | 53,098 | 2002 | January-08 | ||||

| 100 | Star Zeta | Supramax | 52,994 | 2003 | January-08 | ||||

| 101 | Star Delta | Supramax | 52,434 | 2000 | January-08 | ||||

| 102 | Star Theta | Supramax | 52,425 | 2003 | December-07 | ||||

| 103 | Star Epsilon | Supramax | 52,402 | 2001 | December-07 | ||||

| 104 | Star Cosmo | Supramax | 52,247 | 2005 | July-08 | ||||

| 105 | Star Kappa | Supramax | 52,055 | 2001 | December-07 | ||||

| Total dwt: | 11,634,253 | ||||||||

Newbuilding Vessels

| Vessel Name | Vessel Type | Capacity (dwt.) | Shipyard | Expected delivery date | ||||||

| 1 | HN 1388 (1) | Newcastlemax | 208,000 | SWS | Jan-19 | |||||

| 2 | HN 1389 (1) | Newcastlemax | 208,000 | SWS | Feb-19 | |||||

| 3 | HN 1390 (1) | Newcastlemax | 208,000 | SWS | Apr-19 | |||||

| 624,000 | ||||||||||

- Subject to a bareboat charter with purchase obligation at the expiration of the bareboat term.

Second Quarter 2018 and 2017 Results (*)

(*) Amounts relating to variations in period–on–period comparisons shown in this section are derived from the actual numbers in our books and records.

For the second quarter of 2018, time charter equivalent revenues (“TCE Revenues”) (total voyage revenues net of voyage expenses and charter-in hire expense) excluding Star Logistics (as further discussed in footnote 8 under the heading "Summary of Selected Data”) were $90.0 million, compared to $61.1 million for the second quarter of 2017. Total revenues for the second quarter of 2018 increased to $132.6 million from $78.6 million in the second quarter of 2017. This increase was primarily attributable to the significant rise in charter hire rates, which led to a TCE rate of $13,567 for the second quarter of 2018 compared to a TCE rate of $9,747 for the second quarter of 2017, representing a 39% increase. TCE Revenues also increased as a result of an increase in the average number of vessels in our fleet to 73.5 in the second quarter of 2018, up from 69.5 in the second quarter of 2017, which caused an increase in Available days for our fleet.

Absent the adoption of the new revenue recognition standard (ASC 606) in January 2018, which has only prospective application with no effect to prior year figures, our TCE rate for the second quarter of 2018 would have been $13,598.

For the second quarter of 2018, operating income was $27.3 million, which includes depreciation of $22.1 million. Operating income of $2.0 million for the second quarter of 2017 included depreciation of $20.7 million. Depreciation increased during the second quarter of 2018 due to a higher average number of vessels in our fleet.

Net income for the second quarter of 2018 was $10.7 million, or $0.17 earnings per share, basic and diluted, based on 64,233,289 weighted average basic shares and 64,633,668 weighted average diluted shares, respectively. Net loss for the second quarter of 2017 was $10.3 million, or $0.16 loss per share, basic and diluted, based on 63,336,657 weighted average basic and diluted shares.

Net income for the second quarter of 2018 mainly included the following non-cash items, other than depreciation expense:

- Stock-based compensation expense of $3.9 million, or $0.06 per share, basic and diluted, recognized in connection with common shares granted to our directors and employees; and

- Unrealized gain on forward freight agreements and bunker swaps of $1.3 million, or $0.02 per share, basic and diluted.

Net loss for the second quarter of 2017, mainly included the following non-cash items, other than depreciation expense:

- Stock based compensation expense of $3.7 million, or $0.06 per share, basic and diluted, recognized in connection with common shares granted to our directors and employees;

- Unrealized gain on forward freight agreements of $0.7 million, or $0.01 per share, basic and diluted; and

- Unrealized gain on interest rate swaps of $0.4 million or $0.006 per share, basic and diluted.

Adjusted net income for the second quarter of 2018, which excludes major non-cash items other than depreciation expense, was $13.4 million, or $0.21 earnings per share, basic and diluted, compared to adjusted net loss of $7.6 million, or $0.12 loss per share, basic and diluted, for the second quarter of 2017. A reconciliation of Net income / (loss) to Adjusted Net income/ (loss) and Adjusted earnings / (loss) per share basic and diluted is set forth below in the financial tables contained in this release.

Adjusted EBITDA for the second quarter of 2018 and 2017, which excludes all non-cash items, was $52.0 million and $25.7 million, respectively. A reconciliation of EBITDA and Adjusted EBITDA to net cash provided by/(used in) operating activities is set forth below in the financial tables contained in this release.

For the second quarter of 2018 and 2017, vessel operating expenses were $27.4 million and $25.1 million, respectively. This increase was primarily due to the increase in the average number of vessels from 69.5 to 73.5. Vessel operating expenses for the second quarter of 2018 include pre-delivery and pre-joining expenses of $0.7 million incurred mainly in connection with the delivery of the Star Magnanimus and Star Leo, which were delivered in March and May 2018, respectively. For the second quarter of 2017 operating expenses included pre-delivery and pre-joining expenses of $0.6 million. Excluding these expenses, our average daily operating expenses per vessel for the second quarter of 2018 were $3,996, vs. $3,880 for the same period in 2017.

Dry docking expenses for the second quarters of 2018 and 2017 were $2.1 million and $1.9 million, respectively. During the second quarter of 2018, two of our vessels underwent their periodic dry docking surveys, while during the second quarter of 2017, three of our vessels underwent their periodic dry docking surveys, one of which had started during the first quarter of 2017.

General and administrative expenses for the second quarters of 2018 and 2017 were $10.4 million and $9.3 million, respectively. The formation of our new subsidiary, Star Logistics, and a higher EUR/USD exchange rate during the second quarter of 2018 compared to the corresponding period in 2017 resulted in higher wage expenses, and thus had a negative effect on our general and administrative expenses. Additionally, general and administrative expenses for the second quarter of 2018 include stock-based compensation expense of $3.9 million. During the same quarter of 2017, general and administrative expenses included stock-based compensation expense of $3.7 million and legal fees of $0.4 million in connection with the restructuring of our indebtedness. Excluding these costs, our average daily net cash general and administrative expenses per vessel (including management fees) for the second quarter of 2018 were reduced to $1,072 from $1,101, during the second quarter of 2017.

Charter-in hire expense for the second quarters of 2018 and 2017 was $24.3 million and $0.9 million, respectively. The increase in charter-in hire expense was due to an increase in charter-in days from 91 in the second quarter of 2017, attributable to charter-in of the vessel Astakos, to 1,157 in the second quarter of 2018, attributable to the activities of our new subsidiary Star Logistics, which was created in the fourth quarter of 2017 to connect the origination and the destination of dry bulk commodities.

Interest and finance costs net of interest and other income/ (loss) for the second quarters of 2018 and 2017 were $16.6 million and $12.0 million, respectively. The increase is attributable to the increase in (i) LIBOR between the corresponding periods, (ii) the weighted average balance of our outstanding indebtedness of $1,063.4 million during the second quarter of 2018 compared to $1,038.4 million for the same period in 2017 and (iii) the negative effect of exchange rates on our time deposits held in Euros due to unfavorable movement in EUR/USD exchange rates during the second quarter of 2018 compared to the corresponding period in 2017, partially offset by higher interest income earned due to higher outstanding cash balances held in time deposits during the respective periods.

First Half 2018 and 2017 Results (*)

(*) Amounts relating to variations in period–on–period comparisons shown in this section are derived from the actual numbers in our books and records.

For the first half of 2018, time charter equivalent revenues (“TCE Revenues”) (total voyage revenues net of voyage expenses and charter-in hire expense) excluding Star Logistics (as further discussed in footnote 8 under the heading "Summary of Selected Data”) were $171.6 million, compared to $110.1 million for the first half of 2017. Total revenues for the first half of 2018 increased to $253.7 million from $143.5 million in the corresponding period in 2017. This increase was primarily attributable to the significant rise in charter hire rates, which led to a TCE rate of $13,082 for the first half of 2018 compared to a TCE rate of $8,968 for the first half of 2017, representing a 46% increase. TCE Revenues also increased as a result of an increase in the average number of vessels in our fleet to 72.8 in the first half of 2018, up from 68.4 in the first half of 2017, which caused an increase in Available days for our fleet.

Absent the adoption of the new revenue recognition standard (ASC 606) in January 2018, which has only prospective application with no effect to prior year figures, our TCE rate for the first half of 2018 would have been $13,022.

For the first half of 2018, operating income was $50.5 million, which includes depreciation of $43.2 million. Operating loss of $3.3 million for the first half of 2017 included depreciation of $40.4 million and a net loss on sale of vessels of $0.4 million. Depreciation increased during the first half of 2018 due to a higher average number of vessels in our fleet.

Net income for the first half of 2018 was $20.6 million, or $0.32 earnings per share, basic and diluted, based on 64,170,654 weighted average basic shares and 64,468,860 weighted average diluted shares, respectively. Net loss for the first half of 2017 was $26.2 million, or $0.42 loss per share, basic and diluted, based on 62,188,645 weighted average basic and diluted shares.

Net income for the first half of 2018 mainly included the following non-cash items, other than depreciation expense:

- Stock-based compensation expense of $5.0 million, or $0.08 per share, basic and diluted, recognized in connection with common shares granted to our directors and employees; and

- Unrealized gain on forward freight agreements and bunker swaps of $0.3 million, or $0.01 per share, basic and diluted.

Net loss for the first half of 2017, mainly included the following non-cash items, other than depreciation expense:

- Stock based compensation expense of $6.4 million, or $0.10 per share, basic and diluted, recognized in connection with common shares granted to our directors and employees;

- Loss on sale of vessel of $0.4 million, or $0.01 per share, basic and diluted, in connection with the sale of Star Eleonora in March 2017;

- Unrealized gain on interest rate swaps of $1.4 million or $0.02 per share, basic and diluted; and

- Write-off of unamortized deferred finance charges of $0.4 million or $0.01 per share, basic and diluted, in connection with the cancellation of a previous loan commitment.

Adjusted net income for the first half of 2018, which excludes major non-cash items other than depreciation expense, was $25.2 million, or $0.39 earnings per share, basic and diluted, compared to adjusted net loss of $20.5 million, or $0.33 loss per share, basic and diluted, for the first half of 2017. A reconciliation of Net income / (loss) to Adjusted Net income/ (loss) and Adjusted earnings / (loss) per share basic and diluted is set forth below in the financial tables contained in this release.

Adjusted EBITDA for the first half of 2018 and 2017, which excludes all non-cash items, was $98.5 million and $43.8 million, respectively. A reconciliation of EBITDA and Adjusted EBITDA to net cash provided by/(used in) operating activities is set forth below in the financial tables contained in this release.

For the first half of 2018 and 2017, vessel operating expenses were $53.7 million and $49.6 million, respectively. This increase was primarily due to the increase in the average number of vessels from 68.4 to 72.8. Vessel operating expenses for the first half of 2018 and 2017 include pre-delivery and pre-joining expenses of $1.1 million in both periods incurred mainly in connection with the delivery of the new vessels in our fleet during each period. Excluding these expenses, our average daily operating expenses per vessel for the first half of 2018 were $3,993, compared to $3,914 in the same period in 2017.

Dry docking expenses for the first half of 2018 and 2017 were $3.3 million and $3.2 million, respectively. During the first half of 2018, two of our vessels underwent their periodic dry docking surveys, while during the first half of 2017, four of our vessels underwent their periodic dry docking surveys, three of which were completed during this period. However, additional dry docking expenses were incurred during the first half of 2018, due to upcoming dry docking surveys in the second half of 2018.

General and administrative expenses for the first half of 2018 and 2017 were $17.7 million and $17.3 million, respectively. The formation of our new subsidiary, Star Logistics, and a higher EUR/USD exchange rate during the first half of 2018 compared to the corresponding period in 2017 resulted in higher wage expenses, and thus had a negative effect on our general and administrative expenses. Additionally, general and administrative expenses for the first half of 2018 include stock-based compensation expense of $5.0 million. During the same period in 2017, general and administrative expenses included stock-based compensation expense of $6.4 million and legal fees of $0.7 million in connection with the restructuring of our indebtedness. Excluding these expenses, our average daily net cash general and administrative expenses per vessel (including management fees) for the first half of 2018 were reduced to $1,086 from $1,109, during the first half 2017.

During the first half of 2017, we recognized other operational gain of $2.5 million resulting from the settlement proceeds of a commercial dispute.

During the first half of 2017, we recognized a net loss of $0.4 million, in connection with the sale of Star Eleonora.

Charter-in hire expense for the first half of 2018 and 2017 was $40.8 million and $1.7 million, respectively. The increase in charter-in hire expense was due to an increase in charter-in days from 181 in the first half of 2017, attributable to charter-in of the vessel Astakos, to 2,085 in the first half of 2018, attributable to the activities of our new subsidiary Star Logistics, which was created in the fourth quarter of 2017 to connect the origination and the destination of dry bulk commodities.

Interest and finance costs net of interest and other income/ (loss) for the first half of 2018 and 2017 were $29.9 million and $22.5 million, respectively. The increase is attributable to the increase in (i) LIBOR between the corresponding periods, (ii) the weighted average balance of our outstanding indebtedness of $1,054.3 million during the first half of 2018 compared to $1,007.5 million for the same period in 2017 and (iii) the negative effect of exchange rates on our time deposits held in Euros due to unfavorable movement in EUR/USD exchange rates during the second quarter of 2018 compared to the corresponding period in 2017, partially offset by higher interest income earned due to higher outstanding cash balances held in time deposits during the respective periods.

Liquidity and Capital Resources

Cash Flows

Net cash provided by operating activities for the first half of 2018 was $61.1 million, whereas net cash provided by operating activities for the first half of 2017 was $20.1 million.

The positive change was due to the significant recovery of the dry bulk market during the first half of 2018, which resulted in a significantly higher TCE rate of $13,082 compared to $8,968 for the first half of 2017 and is also reflected in the increase of Adjusted EBITDA to $98.5 million for the first half of 2018 from $43.8 million for the corresponding period in 2017. This positive effect was partially offset by (i) a net working capital outflow of $6.9 million during the first half of 2018 compared to a net working capital outflow of $1.7 million for the first half of 2017 and (ii) by higher net interest expense for the first half 2018 compared to the corresponding period in 2017.

Net cash used in investing activities for the first half of 2018 and 2017 was $115.6 million and $109.0 million, respectively.

For the first half of 2018, net cash used in investing activities mainly consisted of $115.9 million paid for advances and other capitalized expenses for our newbuilding and newly delivered vessels delivered during the period.

For the first half of 2017, net cash used in investing activities consisted of:

- $116.7 million paid for advances and other capitalized expenses for our newbuilding and newly delivered vessels;

offset partially by:

- $7.7 million of proceeds from the sale of vessels.

Net cash provided by financing activities for the first half of 2018 and 2017 was $21.5 million and $140.6 million, respectively.

For the first half of 2018, net cash provided by financing activities mainly consisted of:

- $100.0 million increase in lease obligations, relating to three delivered newbuilding vessels, under bareboat charters; and

- $30.0 million of proceeds drawn under the newly entered loan facility with the National Bank of Greece to refinance an existing facility with Commerzbank;

offset partially by:

- $108.7 million paid in aggregate in connection with: (i) the regular amortization of outstanding vessel financings and capital lease installments of $43.1 million and (iii) $65.6 million of excess cash for the quarters ended December 31, 2017 and March 31, 2018, paid pursuant to the cash sweep mechanism in our Supplemental Agreements, during the first half 2018.

For the first half of 2017, net cash provided by financing activities consisted of:

- $79.9 million increase in capital lease obligations, relating to two delivered newbuilding vessels under bareboat charters;

- $16.0 million of proceeds drawn under a loan facility for the financing of Star Charis and Star Suzanna, which were delivered to us during the period; and

- $50.6 million of proceeds from a private placement of our common shares, which was completed in February 2017, which is net of aggregate private placement agent’s fees and expenses of $0.9 million;

offset partially by:

- $5.2 million paid in aggregate in connection with the capital lease installments and the partial prepayment of a loan facility due to the sale of Star Eleonora; and

- $0.7 million of financing fees, paid in connection with the restructuring of our indebtedness.

Summary of Selected Data

| (TCE rates expressed in U.S. dollars) | |||||||

| Second quarter 2018 | Second quarter 2017 | ||||||

| Average number of vessels (1) | 73.5 | 69.5 | |||||

| Number of vessels (2) | 74 | 70 | |||||

| Average age of operational fleet (in years) (3) | 8.3 | 7.8 | |||||

| Ownership days (4) | 6,691 | 6,326 | |||||

| Available days (5) | 6,633 | 6,266 | |||||

| Charter-in days (6) | 1,157 | 91 | |||||

| Fleet utilization (7) | 99.3 | % | 99.1 | % | |||

| Daily Time Charter Equivalent Rate (8) | $ | 13,567 | $ | 9,747 | |||

| Average daily OPEX per vessel (9) | $ | 4,096 | $ | 3,975 | |||

| Average daily OPEX per vessel (excl. pre-delivery expenses) | $ | 3,996 | $ | 3,880 | |||

| Average daily Net Cash G&A expenses per vessel (excluding one-time expenses) (10) | $ | 1,072 | $ | 1,101 | |||

| Six months ended June 30, 2018 | Six months ended June 30, 2017 | ||||||

| Average number of vessels (1) | 72.8 | 68.4 | |||||

| Number of vessels (2) | 74 | 70 | |||||

| Average age of operational fleet (in years) (3) | 8.3 | 7.8 | |||||

| Ownership days (4) | 13,174 | 12,384 | |||||

| Available days (5) | 13,116 | 12,275 | |||||

| Charter-in days (6) | 2,085 | 181 | |||||

| Fleet utilization (7) | 99.6 | % | 99.1 | % | |||

| Daily Time Charter Equivalent Rate (8) | $ | 13,082 | $ | 8,968 | |||

| Average daily OPEX per vessel (9) | $ | 4,075 | $ | 4,002 | |||

| Average daily OPEX per vessel (excl. pre-delivery expenses) | $ | 3,993 | $ | 3,914 | |||

| Average daily Net Cash G&A expenses per vessel (excluding one-time expenses) (10) | $ | 1,086 | $ | 1,109 | |||

- Average number of vessels is the number of vessels that constituted our owned fleet for the relevant period, as measured by the sum of the number of days each operating vessel was a part of our owned fleet during the period divided by the number of calendar days in that period.

- As of the last day of the periods reported.

- Average age of operational fleet is calculated as of the end of each period.

- Ownership days are the total calendar days each vessel in the fleet was owned by us for the relevant period.

- Available days for the fleet are the Ownership days after subtracting off-hire days for major repairs, dry docking or special or intermediate surveys and lay-up days, if any.

- Charter-in days are the total days that we charter-in third-party vessels.

- Fleet utilization is calculated by dividing (x) Available days plus Charter-in days by (y) Ownership days plus charter-in days for the relevant period.

- Represents the weighted average daily TCE rates of our operating fleet (including owned fleet and fleet under charter-in arrangements). TCE rate is a measure of the average daily revenue performance of a vessel on a per voyage basis. Our method of calculating TCE rate is determined by dividing voyage revenues (net of voyage expenses and charter-in hire expense and amortization of fair value of above/below market acquired time charter agreements, if any) by Available days for the relevant time period. Voyage expenses primarily consist of port, canal and fuel costs that are unique to a particular voyage, which would otherwise be paid by the charterer under a time charter contract, as well as commissions. TCE rate is a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company's performance despite changes in the mix of charter types (i.e., voyage charters, time charters, bareboat charters and pool arrangements) under which its vessels may be employed between the periods. We include TCE revenues, a non-GAAP measure, as it provides additional meaningful information in conjunction with voyage revenues, the most directly comparable GAAP measure, and it assists our management in making decisions regarding the deployment and use of our operating vessels and assists investors and our management in evaluating our financial performance. The above reported TCE rates for the second quarter and the first half of 2018, were calculated excluding Star Logistics. We are excluding the revenues and expenses of Star Logistics because it was formed recently, in October 2017, and its revenues and expenses have not yet normalized and could have an effect on our TCE rates that could obscure material trends. As a result, we believe it is more informative to our investors to present the TCE rates excluding the revenues and expenses of Star Logistics until its revenues and expenses have normalized. For the detail calculation please see the table at the back of this release with the reconciliation of Voyage Revenues to TCE.

- Average daily OPEX per vessel is calculated by dividing vessel operating expenses by Ownership days.

- Average daily Net Cash G&A expenses per vessel is calculated by (1) deducting the Management fee Income from, and (2) adding the Management fee expense to, the General and Administrative expenses (net of stock-based compensation expense) and (3) then dividing by the Ownership days and Charter-in days.

Unaudited Consolidated Statement of Operations

| (Expressed in thousands of U.S. dollars except for share and per share data) | Second quarter 2018 | Second quarter 2017 | Six months ended June 30, 2018 | Six months ended June 30, 2017 | ||||||||||||

| Revenues: | ||||||||||||||||

| Voyage revenues | $ | 132,604 | $ | 78,605 | $ | 253,661 | $ | 143,471 | ||||||||

| Total revenues | 132,604 | 78,605 | 253,661 | 143,471 | ||||||||||||

| Expenses: | ||||||||||||||||

| Voyage expenses | (19,891 | ) | (16,650 | ) | (42,586 | ) | (31,649 | ) | ||||||||

| Charter-in hire expense | (24,293 | ) | (881 | ) | (40,763 | ) | (1,736 | ) | ||||||||

| Vessel operating expenses | (27,408 | ) | (25,145 | ) | (53,681 | ) | (49,560 | ) | ||||||||

| Dry docking expenses | (2,149 | ) | (1,856 | ) | (3,269 | ) | (3,248 | ) | ||||||||

| Depreciation | (22,075 | ) | (20,742 | ) | (43,243 | ) | (40,387 | ) | ||||||||

| Management fees | (1,983 | ) | (1,875 | ) | (3,913 | ) | (3,689 | ) | ||||||||

| General and administrative expenses | (10,383 | ) | (9,284 | ) | (17,702 | ) | (17,316 | ) | ||||||||

| Gain/(Loss) on forward freight agreements and bunker swaps | 2,812 | 256 | 2,000 | (541 | ) | |||||||||||

| Other operational loss | - | (751 | ) | - | (751 | ) | ||||||||||

| Other operational gain | 36 | 294 | 41 | 2,461 | ||||||||||||

| Gain/(Loss) on sale of vessels | - | - | - | (370 | ) | |||||||||||

| Operating income/(loss) | 27,270 | 1,971 | 50,545 | (3,315 | ) | |||||||||||

| Interest and finance costs | (16,065 | ) | (12,625 | ) | (30,338 | ) | (23,766 | ) | ||||||||

| Interest and other income/(loss) | (499 | ) | 603 | 394 | 1,223 | |||||||||||

| Gain/(Loss) on derivative financial instruments | - | (147 | ) | (1 | ) | 100 | ||||||||||

| Loss on debt extinguishment | (21 | ) | - | (21 | ) | (358 | ) | |||||||||

| Total other expenses, net | (16,585 | ) | (12,169 | ) | (29,966 | ) | (22,801 | ) | ||||||||

| Income/(Loss) before equity in investee | 10,685 | (10,198 | ) | 20,579 | (26,116 | ) | ||||||||||

| Equity in income/(loss) of investee | 43 | (29 | ) | 49 | 4 | |||||||||||

| Income/(Loss) before taxes | $ | 10,728 | $ | (10,227 | ) | $ | 20,628 | $ | (26,112 | ) | ||||||

| US Source Income taxes | - | (52 | ) | - | (117 | ) | ||||||||||

| Net income/(loss) | $ | 10,728 | $ | (10,279 | ) | $ | 20,628 | $ | (26,229 | ) | ||||||

| Earnings/(loss) per share, basic | $ | 0.17 | $ | (0.16 | ) | $ | 0.32 | $ | (0.42 | ) | ||||||

| Earnings/(loss) per share, diluted | $ | 0.17 | $ | (0.16 | ) | $ | 0.32 | $ | (0.42 | ) | ||||||

| Weighted average number of shares outstanding, basic | 64,233,289 | 63,336,657 | 64,170,654 | 62,188,645 | ||||||||||||

| Weighted average number of shares outstanding, diluted | 64,633,668 | 63,336,657 | 64,468,860 | 62,188,645 | ||||||||||||

Unaudited Consolidated Condensed Balance Sheets

| (Expressed in thousands of U.S. dollars) | ||||||

| ASSETS | June 30, 2018 | December 31, 2017 | ||||

| Cash and cash equivalents | $ | 218,651 | $ | 257,911 | ||

| Other current assets | 69,635 | 54,715 | ||||

| TOTAL CURRENT ASSETS | 288,286 | 312,626 | ||||

| Advances for vessels under construction and acquisition of vessels and other assets | 46,480 | 48,574 | ||||

| Vessels and other fixed assets, net | 1,896,020 | 1,775,081 | ||||

| Other non-current assets | 12,532 | 9,483 | ||||

| TOTAL ASSETS | $ | 2,243,318 | $ | 2,145,764 | ||

| Current portion of long-term debt and finance lease commitments | $ | 142,856 | $ | 189,306 | ||

| Other current liabilities | 38,894 | 29,968 | ||||

| TOTAL CURRENT LIABILITIES | 181,750 | 219,274 | ||||

| Long-term debt and finance lease commitments non-current(net of unamortized deferred finance fees of $6,538 and $7,154, respectively) | 858,205 | 789,878 | ||||

| Senior Notes (net of unamortized deferred finance fees of $1,797 and $2,000, respectively) | 48,203 | 48,000 | ||||

| Other non-current liabilities | 620 | 560 | ||||

| TOTAL LIABILITIES | $ | 1,088,778 | $ | 1,057,712 | ||

| STOCKHOLDERS' EQUITY | 1,154,540 | 1,088,052 | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 2,243,318 | $ | 2,145,764 | ||

Unaudited Cash Flow Data

| (Expressed in thousands of U.S. dollars) | Six months ended June 30, 2018 | Six months ended June 30, 2017 | |||||||

| Net cash provided by / (used in) operating activities | $ | 61,087 | $ | 20,120 | |||||

| Net cash provided by / (used in) investing activities | (115,592 | ) | (109,023 | ) | |||||

| Net cash provided by / (used in) financing activities | 21,501 | 140,563 | |||||||

EBITDA and Adjusted EBITDA Reconciliation

We consider EBITDA to represent net income before interest, income taxes, depreciation and amortization. EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operating activities, as determined by United States generally accepted accounting principles, or U.S. GAAP, and our calculation of EBITDA may not be comparable to that reported by other companies. EBITDA is included herein because it is a basis upon which we assess our liquidity position, because it is a measure used by our lenders as a measure of our compliance with certain loan covenants and because we believe that it presents useful information to investors regarding our ability to service and/or incur indebtedness.

To derive Adjusted EBITDA from EBITDA and Adjusted Net income/(loss) from Net income/(loss), we excluded non-cash gains/losses such as those related to sale of vessels, stock-based compensation expense the write-off of the unamortized fair value of above-market acquired time charters, impairment losses, the write-off of claims receivable, change in fair value of forward freight agreements and bunker swaps and the equity in income/(loss) of investee, if any. We excluded the items described above when deriving Adjusted EBITDA and Adjusted Net income/(loss) because we believe that these items do not reflect the ongoing operational cash inflows and outflows of our fleet.

The following table reconciles net cash provided by operating activities to EBITDA and Adjusted EBITDA:

| (Expressed in thousands of U.S. dollars) | Second quarter 2018 | Second quarter 2017 | Six months ended June 30, 2018 | Six months ended June 30, 2017 | ||||||||||||

| Net cash provided by/(used in) operating activities | $ | 29,505 | $ | 13,791 | $ | 61,087 | $ | 20,120 | ||||||||

| Net decrease / (increase) in current assets | 3,984 | 4,267 | 12,762 | 4,865 | ||||||||||||

| Net increase / (decrease) in operating liabilities, excluding current portion of long term debt | 1,076 | (3,632 | ) | (5,955 | ) | (3,157 | ) | |||||||||

| Loss on debt extinguishment | (21 | ) | - | (21 | ) | (358 | ) | |||||||||

| Stock – based compensation | (3,949 | ) | (3,710 | ) | (5,011 | ) | (6,360 | ) | ||||||||

| Amortization of deferred finance charges | (691 | ) | (647 | ) | (1,367 | ) | (1,288 | ) | ||||||||

| Unrealized and accrued gain/(loss) on derivative financial instruments | 185 | (269 | ) | 573 | 706 | |||||||||||

| Unrealized gain / (loss) on forward freight agreements and bunker swaps | 1,266 | 673 | 349 | (41 | ) | |||||||||||

| Total other expenses, net | 17,990 | 12,169 | 31,371 | 22,801 | ||||||||||||

| Income tax | - | 52 | - | 117 | ||||||||||||

| Gain/(Loss) on sale of vessel | - | - | - | (370 | ) | |||||||||||

| Equity in income/(loss) of investee | 43 | (29 | ) | 49 | 4 | |||||||||||

| EBITDA | $ | 49,388 | $ | 22,665 | $ | 93,837 | $ | 37,039 | ||||||||

| Less: | ||||||||||||||||

| Equity in income of investee | (43 | ) | - | (49 | ) | (4 | ) | |||||||||

| Unrealized gain on forward freight agreements and bunker swaps | (1,266 | ) | (673 | ) | (349 | ) | - | |||||||||

| Plus: | ||||||||||||||||

| Stock-based compensation | 3,949 | 3,710 | 5,011 | 6,360 | ||||||||||||

| Loss on sale of vessel | - | - | - | 370 | ||||||||||||

| Unrealized loss on forward freight agreements and bunker swaps | - | - | - | 41 | ||||||||||||

| Equity in loss of investee | - | 29 | - | - | ||||||||||||

| Adjusted EBITDA | $ | 52,028 | $ | 25,731 | $ | 98,450 | $ | 43,806 | ||||||||

Net income / (loss) and Adjusted Net income / (loss) Reconciliation

| (Expressed in thousands of U.S. dollars) | Second quarter 2018 | Second quarter 2017 | Six months ended June 30, 2018 | Six months ended June 30, 2017 | ||||||||||||

| Net income / (loss) | $ | 10,728 | $ | (10,279 | ) | $ | 20,628 | $ | (26,229 | ) | ||||||

| Stock – based compensation | 3,949 | 3,710 | 5,011 | 6,360 | ||||||||||||

| Unrealized (gain) / loss on forward freight agreements and bunker swaps | (1,266 | ) | (673 | ) | (349 | ) | 41 | |||||||||

| Unrealized (gain) / loss on derivative financial instruments | (12 | ) | (411 | ) | (26 | ) | (1,374 | ) | ||||||||

| (Gain) / loss on sale of vessel | - | - | - | 370 | ||||||||||||

| Amortization of deferred gain from sale and leaseback | - | (19 | ) | - | (37 | ) | ||||||||||

| Loss on debt extinguishment | 21 | - | 21 | 358 | ||||||||||||

| Equity in income/(loss) of investee | (43 | ) | 29 | (49 | ) | (4 | ) | |||||||||

| Adjusted Net income / (loss) | $ | 13,377 | $ | (7,643 | ) | $ | 25,236 | $ | (20,515 | ) | ||||||

| Weighted average number of shares outstanding, basic | 64,233,289 | 63,336,657 | 64,170,654 | 62,188,645 | ||||||||||||

| Weighted average number of shares outstanding, diluted | 64,633,668 | 63,336,657 | 64,468,860 | 62,188,645 | ||||||||||||

| Adjusted Basic Earnings / (Loss) Per Share | $ | 0.21 | $ | (0.12 | ) | $ | 0.39 | $ | (0.33 | ) | ||||||

| Adjusted Diluted Earnings / (Loss) Per Share | $ | 0.21 | $ | (0.12 | ) | $ | 0.39 | $ | (0.33 | ) | ||||||

Voyage Revenues to Daily Time Charter Equivalent (“TCE”) Reconciliation (please refer to the section “Summary of Selected Data” for the calculation method of TCE)

| (In thousands of U.S. Dollars, except as otherwise stated) | ||||||||||||||||

| Second quarter 2018 | Second quarter 2017 | Six months ended June 30, 2018 | Six months ended June 30, 2017 | |||||||||||||

| Voyage revenues | $ | 103,665 | (a) | $ | 78,605 | $ | 201,620 | (b) | $ | 143,471 | ||||||

| Less: | ||||||||||||||||

| Voyage expenses | (13,674 | ) | (c) | (16,650 | ) | (30,032 | ) | (d) | (31,649 | ) | ||||||

| Charter-in hire expenses | - | (e) | (881 | ) | - | (f) | (1,736 | ) | ||||||||

| Time Charter equivalent revenues | $ | 89,991 | $ | 61,074 | $ | 171,588 | $ | 110,086 | ||||||||

| Available days for fleet | 6,633 | 6,266 | 13,116 | 12,275 | ||||||||||||

| Daily Time Charter Equivalent Rate ("TCE") | $ | 13,567 | $ | 9,747 | $ | 13,082 | $ | 8,968 | ||||||||

- Voyage revenues used to calculate TCE rate for the second quarter of 2018 consist of (1) reported voyage revenues of $132.6 million minus (2) voyage revenues of $28.9 million attributable to Star Logistics.

- Voyage revenues used to calculate TCE rate for the first half of 2018 consist of (1) reported voyage revenues of $253.7 million minus (2) voyage revenues of $52.0 million attributable to Star Logistics.

- Voyage expenses used to calculate TCE rate for the second quarter of 2018 consist of (1) reported voyage expenses of $19.9 million minus (2) voyage expenses of $6.2 million attributable to Star Logistics.

- Voyage expenses used to calculate TCE rate for the first half of 2018 consist of (1) reported voyage expenses of $42.6 million minus (2) voyage expenses of $12.6 million attributable to Star Logistics.

- Charter-in hire expenses used to calculate TCE rate for the second quarter of 2018 consist of (1) reported charter-in hire expenses of $24.3 million minus (2) charter-in hire expenses of $24.3 million attributable to Star Logistics.

- Charter-in hire expenses used to calculate TCE rate for the first half of 2018 consist of (1) reported charter-in hire expenses of $40.8 million minus (2) charter-in hire expenses of $40.8 million attributable to Star Logistics.

Conference Call details:

Our management team will host a conference call to discuss our financial results on Wednesday, August 8, 2018 at 11:00 a.m., Eastern Time (ET).

Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 1 (877) 553-9962 (US Toll Free Dial In), 0(808) 238- 0669 (UK Toll Free Dial In) or +44 (0) 2071 928592 (Standard International Dial In). Please quote "Star Bulk" to the operator.

A telephonic replay of the conference call will be available until August 15, 2018, by dialing 1(866) 331-1332 (US Toll Free Dial In), 0(808) 238-0667 (UK Toll Free Dial In) or +44 (0) 3333 009785 (Standard International Dial In) and the access code required for the replay is: 3128607#.

Slides and audio webcast:

There will also be a simultaneous live webcast over the Internet through the Star Bulk website (www.starbulk.com). Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

About Star Bulk

Star Bulk is a global shipping company providing worldwide seaborne transportation solutions in the dry bulk sector. Star Bulk’s vessels transport major bulks, which include iron ore, coal and grain, and minor bulks, which include bauxite, fertilizers and steel products. Star Bulk was incorporated in the Marshall Islands on December 13, 2006 and maintains executive offices in Athens, Greece. Its common stock trades on the Nasdaq Global Select Market under the symbol “SBLK” and on the Oslo Stock Exchange under the ticker “SBLK R”. On a fully delivered basis, Star Bulk will have a fleet of 108 vessels, with an aggregate capacity of 12.26 million dwt, consisting of 17 Newcastlemax, 18 Capesize, 2 Mini Capesize, 7 Post Panamax, 35 Kamsarmax, 2 Panamax, 16 Ultramax and 11 Supramax vessels with carrying capacities between 52,055 dwt and 209,537 dwt.

Forward-Looking Statements

Matters discussed in this press release may constitute forward looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect,” “pending” and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, examination by the Company’s management of historical operating trends, data contained in its records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include general dry bulk shipping market conditions, including fluctuations in charterhire rates and vessel values; the strength of world economies; the stability of Europe and the Euro; fluctuations in interest rates and foreign exchange rates; changes in demand in the dry bulk shipping industry, including the market for our vessels; changes in our operating expenses, including bunker prices, dry docking and insurance costs; changes in governmental rules and regulations or actions taken by regulatory authorities; potential liability from pending or future litigation; general domestic and international political conditions; potential disruption of shipping routes due to accidents or political events; the availability of financing and refinancing; our ability to meet requirements for additional capital and financing to complete our newbuilding program and grow our business; the impact of the level of our indebtedness and the restrictions in our debt agreements; vessel breakdowns and instances of off‐hire; risks associated with vessel construction; potential exposure or loss from investment in derivative instruments; potential conflicts of interest involving our Chief Executive Officer, his family and other members of our senior management and our ability to complete acquisition transactions as planned. Please see our filings with the Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties. The information set forth herein speaks only as of the date hereof, and the Company disclaims any intention or obligation to update any forward‐looking statements as a result of developments occurring after the date of this communication.

'관심종목' 카테고리의 다른 글

| 서정진, 셀트리온 원가경쟁력 높이기 위해 베트남에 3공장 세우나 (0) | 2018.08.13 |

|---|---|

| 서정진, 셀트리온 대장암치료 바이오시밀러 가격으로 승부 건다 (0) | 2018.08.10 |

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

글

바이오스펙테이터 장종원 기자

영업이익은 1092억원으로 21.7% 감소.."신약개발 등 비용 증가"

셀트리온의 2분기 영업이익이 20%가량 급감했다. cGMP 프로세스 개선을 위한 외부 컨설팅 비용, 신약 개발에 따른 경상개발비, 미국 시장 조기진입을 위한 특허 소송 비용 등이 증가한데 따른 것이다. 매출은 7%가량 증가했는데 트룩시마의 매출이 폭발적으로 늘고 있다는 점이 고무적이다.

셀트리온은 2018년 2분기 연결기준 영업실적으로 매출액은 2634억원, 영업이익은 1082억원을 기록했다고 8일 공시했다. 매출은 전년 동기 대비 7% 증가, 영업이익은 21.7% 감소했다.

셀트리온은 자가면역치료용 항체 바이오시밀러인 램시마의 지속적 유럽시장 점유율 확대 및 미국 시장 판매 확대, 지난해 4월 유럽에서 판매에 돌입한 혈액암 치료용 항체 바이오시밀러 트룩시마의 시장점유율 확대 등 바이오시밀러 제품 판매 증가로 인해 매출이 증가했다고 설명했다.

특히 2분기 전체 매출에서 트룩시마의 비중이 57%에 달했다. 램시마는 24%, 기타 CMO 등 용역서비스 매출 및 자회사 매출이 19% 였다. 트룩시마는 작년 2월 유럽의약품청 판매허가를 얻어 같은해 4월 출시됐는데 현재 20여개 국가서 판매되고 있다. 네덜란드와 영국에서는 출시 3분기 만에 네덜란드 58%, 영국 43%의 시장 점유율을 기록하기도 했다.

영업이익 감소는 cGMP 프로세스 개선을 위한 외부 컨설팅 비용 반영, 신약 개발에 따른 경상개발비 증가, 미국 시장 조기진입을 위한 특허 소송 비용 증가, 기업이미지 제고를 위한 기업광고선전비 집행 등 일시적 비용 증가에 기인했다.

셀트리온 관계자는 “2분기는 종합독감 인플루엔자 항체 신약 CT-P27 임상비용 및 트룩시마, 허쥬마의 미국 특허 소송비용 증가, 기업광고비 집행 등에 따라 비용이 증가했다”면서 "허쥬마의 유럽 진출에 따른 3개 바이오시밀러 제품의 제품믹스 효과 및 매출 성장에 따른 규모의 경제 효과로 앞으로도 견조한 실적이 유지될 것으로 예상된다"고 강조했다. 이 관계자는 "연내 트룩시마, 허쥬마 2개 제품의 미국 승인과 내년도 램시마 SC제형 유럽 출시 등이 계획돼 있어 중장기적으로도 지속적인 실적 성장을 기대하고 있다”고 덧붙였다.

'관심종목' 카테고리의 다른 글

| 서정진, 셀트리온 대장암치료 바이오시밀러 가격으로 승부 건다 (0) | 2018.08.10 |

|---|---|

| Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018 (0) | 2018.08.10 |

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

| 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉 (0) | 2018.07.17 |

글

두회사 5년간 6개 타깃+α CAR-T 공동 개발, 리제네론 IND 신청 단계에서 옵션권리 보유, 옵션 행사시 양사 50/50 공동개발 상업화 및 이익 분배..."최근 2년간 빅파마 CAR-T 회사 인수/파트너십 체결 주목"

리제네론파마슈티컬(Regeneron Pharmaceuticals)이 블루버드바이오(bluebird bio)와의 협력을 통해 CAR-T 치료제 포토폴리오를 추가했다. 리제네론-블루버드바이오는 각 회사가 보유한 기술플랫폼을 기반으로 항암 세포치료제의 발굴, 개발 및 상업화에 대한 협력을 체결했다고 지난 6일 밝혔다.

리제네론-사노피는 미국 시장에서 3번째 PD-1 약물인 '세미플리맙(REGN2810)'의 시판을 앞두고 있는 회사다. 리제네론은 최근 LAG-3, CTLA-4 타깃 항체와 CD3 하이브리드(hybrid) 이중항체 등의 면역항암제 프로그램을 강화하는 움직임을 보이고 있다. 그리고 CAR-T 분야의 선두주자인 블루버드바이와 협력하면서 세포치료제 분야로 뛰어든 것. 이날 개장과 함께 블루버드바이오의 주가는 7% 올랐다.

이번 협약에 따라 리제네론은 블루버드바이오에 지분투자를 감행했다. 리제네론은 블로버드바이오 주식을 지난3일 종가인 150달러에 59% 프리미엄을 추가한 238.10달러 가격으로 매입, 총 1억달러(1126억원) 규모를 투자키로 결정했다. 3700만달러에 해당하는 프리미엄은 공동 연구비용으로 투입될 계획이다.

두 회사는 5년간 6개 타깃(비공개)에 대한 T세포 치료제를 공동개발하며, 협력기간 동안 타깃을 추가할 수 있다. 초기 연구개발부터 임상승인신청서제출(IND filing) 단계까지 비용을 공동부담한다. 이후 리제네론은 공동개발, 상업화 및 이익(profit)을 50/50으로 배분하는 옵션을 선택할 수 있으며, 리제네론이 옵션을 포기할 경우, 블루버드바이오로부터 마일스톤 및 로얄티를 지급받을 수 있다.

리제네론은 완전인간(fully human) 항체를 발굴하는 VelociSuite 플랫폼기술을 보유하고 있어, 특정 암 항원에 최적화된 TCR를 스크리닝할 수 있다. 블루버드바이오는 T세포에 CAR를 전달하는 렌티바이러스 벡터기술을 보유하고 있다.

George D. Yancopoulos 리제네론 최고과학책임자(CSO)는 "이번 협력은 빠르게 발전하고 있는 면역항암제 후보물질 및 병용접근법에 또 다른 차원을 더한다"며 그 의미를 설명했다.

Philip Gregory 블루버드바이오 CSO는 "협력을 통해 전임상~임상 단계의 블루버드바이오의 CAR-T를 포함한 T세포 치료제 포토폴리오를 보완할 수 있다"며 "리제네론의 검증된 타깃발굴 플랫폼이 우리의 벡터기술 및 CAR-T 개발 역량과 만나, 빠른 시일내 암환자에 신규 세포치료제를 제공할 것"이라고 말했다.

최근 빅파마가 인수하거나 공동협약을 체결하는 방식으로 CAR-T 개발 대열에 동참하면서, 경쟁이 심화되고 있다. 2년 사이에 길리어드(카이트파마), J&J(난징레전드), 다케다(노일이뮨), 셀진(주노), 화이자(셀레틱스-Allogen), 애브비(Calibr) 등이 CAR-T에 뛰어들었다.

한편 블루버드바이오는 재발성/불응성 다발성골수종을 타깃한 BCMA CAR-T로 'bb2121(P2/3)', 'bb21217(P1/2)' 파이프라인을 진행중이다.

'관심종목' 카테고리의 다른 글

| Star Bulk Carriers Corp. Reports Financial Results for the Second Quarter and First Half of 2018 (0) | 2018.08.10 |

|---|---|

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

| 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉 (0) | 2018.07.17 |

| posco 견조한 실적 지속 (0) | 2018.07.06 |

글

http://www.docdocdoc.co.kr/news/articleView.html?idxno=1058825

자타가 인정하는 바이오시밀러 강자 셀트리온이 바이오 오리지네이터 개발사로 변모를 꾀하고 있다.

임상 정보 공유 사이트인 크리니컬트라이얼스에 따르면 셀트리온은 최근 독감(인플루엔자) 치료신약 후보물질 CT-P27의 2b상을 마무리 했다.

셀트리온은 바이오 오리지네이터 파이프라인 중 하나인 CT-P27을 유행성·계절성 독감 치료제로 개발 중이다.

CT-P27은 현재까지의 임상시험 결과 인플루엔자 바이러스 대부분에 효과가 있는 것으로 알려졌다.

계획대로 임상시험을 마치고 상업화될 경우, 현재 독감 시장을 장악하고 있는 타미플루, 리렌자 등을 위협하는 약물로 자리매김할 수 있다.

셀트리온은 CT-P27 개발에 오랫동안 공을 들였다.

지난 2009년 항체 시장에 관심을 보였던 셀트리온은 CT-P27을 개발, 영국 의약품 허가기관(MHRA)의 승인을 받아 2013년 11월 1상을 마쳤다.

이어 2014년 8월에는 건강한 참가자에게 인위적으로 인플루엔자를 감염시킨 후 CT-P27의 안전성과 유효성을 평가하는 2a상도 완료했다.

이번에 완료한 2b상은 2016년 12월부터 서울성모병원, 경희대학교병원 등 국내 의료기관에서 183명을 대상으로 CT-P27의 유효성과 안전성을 평가했다.

3상은 올해 내 개시될 것으로 예상된다.

셀트리온은 현재 CT-P27 외에도 유방암치료제 CT-P26, 독감 백신 CT-P25, B형 간염치료제 CT-P24, 광견병치료제 CT-P19 등 다양한 항체 신약 파이프라인을 확보하고 있다.

때문에 제약업계 안팎에선 CT-P27가 3상을 무사히 마치고 상용화에 성공할 경우 다른 신약들의 개발에도 박차가 가해질 것으로 내다보고 있다.

셀트리온의 바이오시밀러 성공신화가 오리지널 신약에서도 이어질 지 귀추가 주목된다.

한편 셀트리온이 개발한 세계 최초 바이오시밀러 램시마는 올해 상반기 미국에서 6,300만달러(한화 약 706억원)의 매출을 기록했다. 전년 동기 2,300만달러(한화 약 258억원) 대비 174% 수준 증가한 수치다.

'관심종목' 카테고리의 다른 글

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

|---|---|

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉 (0) | 2018.07.17 |

| posco 견조한 실적 지속 (0) | 2018.07.06 |

| [중국인물] 7조원짜리 과외기업 만든 사교육의 대부 장방신 (0) | 2018.06.26 |

글

http://www.dailypharm.com/Users/News/NewsView.html?ID=241838

안과 강자 삼천당제약이 아일리아 바이오시밀러 개발에 착수한다. 올해 말 전임상에 들어간 후 내년 3분기쯤 미국 식품의약국(FDA)에 3상(1상 포함) 신청서를 제출한다. 아일리아 특허가 끝나는 2023년이 개발 목표 시점이다.

아일리아는 리제네론과 바이엘이 공동개발한 황반변성치료제로 지난해 매출은 63억 달러(7조1000억원)에 달하는 블록버스터다. 글로벌에서 허가받은 황반병성치료제는 노바티스 '루센티스'와 '아일리아'가 유일하다. 상업화시 희소성을 확보할 수 있다.

16일 삼천당제약에 따르면, 이 회사는 신규 사업으로 바이오시밀러, 줄기세포 치료술, 무채혈 혈당측정기 사업을 추진 중이다.

바이오시밀러는 아일리아 오리지널을 겨냥하고 있다. 현재 스케일 업(Scale up) 및 커머셜 프로세스(commercial process) 단계에 있다. 시료 생산은 상업화 능력을 증명하기 위해 2000L로 준비중이다.

개발 타임라인은 올해말 비임상 진입, 내년 3분기 정도에 미국 FDA 임상 시험 계획서(IND)를 신청하는 것이다. 3상 환자수는 700명 정도로, 500억원 정도가 투입될 계획이다. 단 임상 규모는 유동적일 수 있다.

삼천당제약은 IND 신청 후 임상 종료까지 2년 3개월 정도를 잡고 있다. 2023년 아일리아 특허 만료일을 맞춰 개발을 완료하겠다는 의지다.

바이오시밀러 3상 및 상업화시 제품 생산은 해외 의약품위탁생산(CMO)에서 진행된다. 글로벌 빅파마 2곳은 이미 해당 CMO 실사를 마친 상태다. 빅파마 2곳은 삼천당제약 3상 비용도 일부 부담하는 것으로 알려졌다.

회사 관계자는 "아일리아 바이오시밀러는 3년전부터 회사가 집중적으로 개발에 착수했던 분야"라며 "라이선스 계약은 3상까지 개발을 마치고 한다는 것이 회사 원칙"이라고 강조했다.

한편 삼천당제약(삼천당)은 다회용 안과용제에 특화된 전문의약품 업체다. 2000년 10월 코스닥에 상장됐다. 연결 자회사는 일회용 안과용제 전문업체 디에이치피코리아다. 2012년 지분 61.3%를 139억원에 인수했다.

삼천당제약은 최근 잇단 수출 계약을 맺었다. 2016년 12월 미국 Breckenridge Pharmaceuticals와 안과용 제네릭 7개 품목(계약금 78억원), 올 2월 20일 미국 Glenmark Pharmaceuticals와 녹내장 및 항알러지제, 항염제 등 6개 품목(계약금 6억원), 올 2월 26일 독일 Omnivision과 녹내장 치료제 4개 품목(계약금 31억원) 등이다. 삼천당제약의 미국 수출을 위한 cGMP 인증 예상 허가 시점은 2019년이다.

'관심종목' 카테고리의 다른 글

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

|---|---|

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

| posco 견조한 실적 지속 (0) | 2018.07.06 |

| [중국인물] 7조원짜리 과외기업 만든 사교육의 대부 장방신 (0) | 2018.06.26 |

글

2Q18 Preview: 기대했던 수준엔 미치지 못하지만 견조한 실적 흐름세는 지속

별도 영업이익 9,840억원(yoy +68%), 연결 영업이익 1조 3,610억원(yoy +39%) 전망

2Q18 별도 및 연결 영업이익이 당초 당사가 전망(6/7일 보고서)했던 수준에 미치지 못할 것으로 추정

된다. 중국 열연 유통가격이 지난 1Q에 이어 2Q에도 전분기대비 상승(+11달러/톤)했으나, 내수 국산

열연 유통가격은 시장 경쟁심화 등의 영향에 따라 전분기대비 톤당 약 3만원 이상 하락했다. 중국 냉

연 유통가격은 열연과 다르게 전분기대비 톤당 20달러 하락했으며, 국내 시장 역시 자동차강판 가격은

동결된 것으로 추정되는 가운데 냉연업체들의 일반냉연 가격 인상 시도가 이루어졌으나 반영은 미진했

던 것으로 판단된다. 이에 따라 POSCO의 탄소강ASP는 전분기대비 상승할 것으로 예상되나 그 수준

은 당초 기대했던 수준을 밑돌 것으로 추정(2Q 탄소강ASP, 전분기대비 0.9만원 상승 예상)된다. 철광

석 및 원료탄 등 주요 원재료 투입원가는 전분기와 유사한 수준(전분기대비 0.2만원/톤 하락)을 나타낼

것으로 판단된다. 따라서 탄소강 스프레드는 전분기대비 개선되어 긍정적인 영향을 미치나, 전분기

930만톤에 달했던 판매량이 2Q에는 890만톤 수준까지 감소함에 따라 영업이익은 전분기대비 감소할

것으로 전망된다. 2Q18 별도 영업이익은 9,840억원으로 추정된다.

철강 자회사 실적 양호 예상, 달러강세는 영업외손익에 부정적 영향 미쳐

1Q18 대비 1)철강(본사제외)부문 유지, 2)무역, E&C, 기타 부문 감소 전망

해외 철강 자회사들의 경우 전분기와 유사한 수준의 영업이익을 창출했을 것으로 사료된다. 반면 무역,

E&C, 기타(에너지포함) 부문의 경우 계절적 비수기 등의 영향에 따라 전분기대비 영업이익이 감소할

것으로 전망된다. 매매기준율 기준 6월말 원/달러 환율이 1,122원/달러를 기록하여 3월말 1,067원/

달러 대비 큰 폭으로 원화약세가 진행됐다. 이에 따라 약 600억원의 외화환산손실(별도)을 기록했을

것으로 판단된다. 또한 브라질 헤알화 역시 미국 달러대비 약세가 진행되며 브라질 CSP의 순손실 규

모가 전분기대비 확대됐을 것으로 추정된다. 2Q18 연결 영업이익은 1조 3,610억원으로 추정된다.

상반기 탄소강ASP 상승폭은 다소 아쉬운 수준

2017년 하반기부터 이어진 중국 철강재 가격 상승 등을 감안했을 시 POSCO의 2018년 상반기 탄소

강ASP 상승세는 다소 아쉬움이 느껴진다. 그러나, 중국 철강재 가격이 높은 수준에서 유지되고 있어

하반기에는 추가적인 판매가격 상승 및 주요 원재료 투입원가 하락 영향으로 스프레드 확대 움직임은

이어질 것으로 판단된다.

Company Report

2018.07.03

POSCO (005490)

2Q18 Preview: 견조한 실적 흐름세 지속

Forecasts

'관심종목' 카테고리의 다른 글

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

|---|---|

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

| 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉 (0) | 2018.07.17 |

| [중국인물] 7조원짜리 과외기업 만든 사교육의 대부 장방신 (0) | 2018.06.26 |

글

http://www.newspim.com/news/view/20171129000164

장방신은 ‘온라인 교육’의 가능성을 빨리 발견했고, 실제로 중국 온라인 교육시장이 황금기를 맞이함에 따라 그의 하오웨이라이도 함께 성장하고 있다. 시장조사기관 아이리서치(艾瑞咨詢)에 따르면, 지난 2016년 중국 온라인 교육시장 규모는 1560억2000만위안(약 25조원)이었지만, 오는 2019년 2600억위안(약 42조원)까지 확대될 것으로 관측된다.

TAL 주식 매수한 지 1년 가까이 되는데 계속 얼마까지 성장할 지 끝까지 지켜 보겠음.

'관심종목' 카테고리의 다른 글

| 셀트리온, 2분기 매출 2634억..트룩시마 비중 57% (0) | 2018.08.09 |

|---|---|

| Regeneron Pharmaceuticals 리제네론, 블루버드와 CAR-T 공동개발.."1억弗 투자" (0) | 2018.08.08 |

| 셀트리온의 바이오시밀러 성공신화, 항체 신약에도 이어질까 (0) | 2018.08.06 |

| 삼천당, 아일리아 시밀러 개발…내년 FDA 3상 신청 2023년 개발 완료 목표…글로벌 빅파마 2곳 접촉 (0) | 2018.07.17 |

| posco 견조한 실적 지속 (0) | 2018.07.06 |

20180701152105437_1.pdf

20180701152105437_1.pdf

RECENT COMMENT